Interesting facts and stats about Salesforce

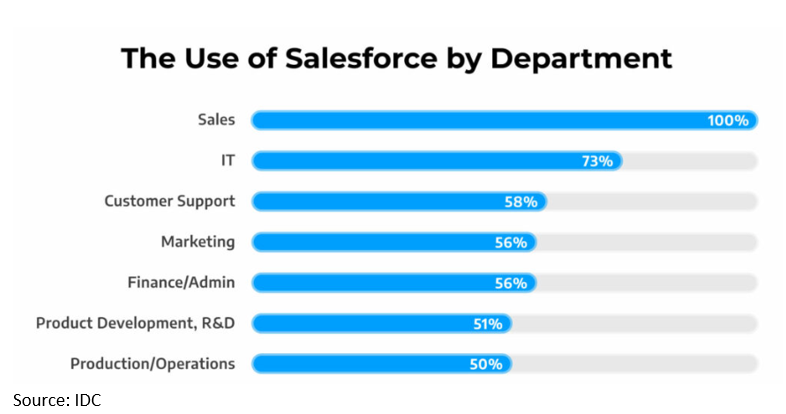

Regarding departmental usage of Salesforce within the company, traditionally, it is the sales department that predominantly utilizes Salesforce. They are succeeded in usage by the IT department, followed by Customer Support, Marketing, and the Finance/Administrative departments. In contrast, the Product Development and Operations departments exhibit comparatively lower utilization of Salesforce, as evidenced by the accompanying graph. This highlights that Salesforce serves to optimize the entire business, contrary to the common perception that it is exclusively employed by the Sales department. Below, you’ll find a breakdown of the specific Salesforce products employed by various departments:

Companies that implement Salesforce expect various positive outcomes from their newly adopted solutions, and these expectations are as follows:

- Improved Customer Experience (30%): One of the primary expectations is an enhanced customer experience. Salesforce enables businesses to better understand and engage with their customers, leading to higher satisfaction and loyalty.

- Operational Improvements (25%): Salesforce solutions are anticipated to bring operational efficiencies. Companies look to streamline their internal processes, reduce manual work, and achieve better overall workflow optimization.

- Higher Employee Productivity (23%): Salesforce tools are expected to boost employee productivity. By automating tasks and providing easy access to relevant information, employees can work more efficiently and effectively.

- Faster Research and Development (R&D) and Product Development (22%): Salesforce can accelerate research and development efforts, leading to quicker product development cycles. It provides a platform for collaboration and data-driven decision-making, expediting innovation.

Regardless of the number of companies that have adopted Salesforce, some remarkable facts stand out:

- Project Payback in One Year: Numerous Salesforce customer success stories highlight that companies often achieve project payback within just one year of implementing Salesforce solutions. This rapid return on investment demonstrates the effectiveness of the platform.

- 58% Payback in Less Than a Year: Some companies that use Salesforce report an astonishing 58% payback in less than a year. This swift ROI underscores the immediate benefits that Salesforce can bring to organizations.

- ROI as High as 500%: For certain companies that utilize Salesforce, the return on investment can be exceptionally high, reaching up to 500%. This remarkable ROI reflects the substantial value that Salesforce can deliver to businesses.

- Interest in Additional Salesforce Clouds: Among existing customers who have acquired the core Salesforce service, approximately 60% express eagerness to purchase additional Salesforce clouds. This indicates a high level of satisfaction and a desire to expand the use of Salesforce within organizations.

In summary, companies adopting Salesforce have high expectations, including improved customer experiences, operational enhancements, increased employee productivity, and accelerated R&D and product development. The platform’s ability to deliver rapid payback, high ROI, and the potential for further expansion within organizations further emphasize its value and effectiveness.

Salesforce’s Growth Over Time:

Salesforce has undergone substantial growth throughout its existence, encompassing both the expansion of the company’s size and its revenue. Over the last two decades:

- Revenue Growth: Salesforce’s revenue has exhibited remarkable growth, with a Compound Annual Growth Rate (CAGR) of 51.22% over the past 20 years. Additionally, the company has achieved a compound revenue growth rate of 29.04% over the last decade. This impressive financial growth is a testament to the company’s market success.

- Employee Growth: Salesforce’s workforce has consistently expanded since its inception, demonstrating stable growth in recent years. As the company has extended its reach to international markets and expanded its operations, the number of employees has steadily increased. As of 2023, Salesforce employs approximately 79,390 individuals, marking an approximate 8% increase compared to the previous year’s employee count of 73,541.

Salesforce Revenue:

General Revenue: Salesforce’s annual revenue has witnessed remarkable growth, reaching a staggering $31.35 billion in 2023, compared to $26.5 billion in 2022 and $21.3 billion in 2021. Projections indicate that Salesforce’s revenue is poised to continue its ascent, with an expected all-time high of $34.6 billion in 2024 and an astonishing $50 billion in 2026. This represents an impressive year-over-year growth rate of 18%. Notably, Salesforce’s revenue in 2022 is ten times higher than it was a decade ago.

Salesforce Services Revenue: In recent times, Salesforce has seen a 14% increase in subscription and support revenues, along with a 19% increase in professional services revenue. Presently, subscription and support services account for over 93% of Salesforce’s revenue, totaling approximately $29 billion in 2023. Professional services constitute a smaller portion, approximately 7% of the company’s fiscal year revenue, equating to just over $2 billion in 2023. It is expected that the share of professional services in the company’s total annual revenue will grow by the end of the year.

Salesforce’s annual returns primarily stem from Salesforce AppExchange revenue and Subscriptions and Support, constituting 93.1% of the revenue, with a smaller portion attributed to Professional Services and other activities at 6.9%.

Salesforce Products Revenue: Salesforce offers four major products tailored to specific aspects of business:

- Sales Cloud

- Service Cloud

- Platform (and Other)

- Marketing and Commerce

The majority of Salesforce’s revenue is derived from “Service Cloud,” which generated nearly $7 billion in total revenue in 2023. In the past, the primary revenue source was Sales Cloud, but in the current year, it generated slightly over $5 billion, making it the third-highest revenue among the company’s products, while still showing an increase compared to the previous year.

Salesforce Platform, encompassing various products, including Tableau and MuleSoft, ranked second in revenue, generating approximately $6 billion combined, marking a 40% increase compared to the previous year. Marketing and Commerce Cloud, with its marketing automation capabilities and commerce campaigns, accounted for $3.13 billion in revenue.

Furthermore, Salesforce operates as an ecosystem rather than just four cloud services. According to Salesforce statistics, 86% of customers utilize partner apps and solutions. This underscores that Salesforce should be viewed as a comprehensive ecosystem encompassing related products, add-on cloud subscriptions, and IT solutions offered by CRM consulting firms and software developers. These entities guide Salesforce customers through CRM implementation and integration processes, expanding the platform’s reach and impact.

Salesforce’s Strategic Acquisitions and Subsidiaries:

Salesforce’s remarkable growth is largely attributed to its strategic acquisitions and development of subsidiaries, which have solidified its position in the technology industry and enriched its ability to deliver comprehensive solutions to its clients. Here, we explore some of Salesforce’s recent acquisitions and their impact on the company’s expansion.

Recent Acquisitions: One of Salesforce’s most notable recent acquisitions is Slack, a workplace messaging service renowned for its inner business communication and integration capabilities. The acquisition was announced in December 2020 and fully completed in July 2021, making it one of the most significant software acquisitions to date, with a staggering deal worth $27.7 billion. The primary objective of this acquisition was to seamlessly integrate Slack’s popular messaging and collaboration tools into Salesforce’s CRM ecosystem. This strategic move aimed to address the increasing importance of remote work and the need for efficient team communication and collaboration. Salesforce’s acquisition of Slack has proven highly successful, boosting the company’s revenue by nearly $600 million in the latter half of fiscal year 2022 and is expected to contribute an additional $1.5 billion to Salesforce’s total revenue for fiscal year 2023. Slack has also become an integral part of Salesforce’s ecosystem, accessible through Salesforce’s marketplace, AppExchange.

In 2022, Salesforce continued its acquisition strategy to reinforce its existing ecosystem and infrastructure. It completed three major acquisitions:

- Traction on Demand: A consultancy firm that enhances Salesforce’s consulting capabilities, allowing for more comprehensive client support.

- Phennecs: A compliance services vendor that strengthens Salesforce’s offerings in ensuring regulatory compliance for its clients.

- Troops.ai: A provider of sales automation bots, which further enhances Salesforce’s tools for sales automation and efficiency.

These strategic acquisitions underscore Salesforce’s commitment to staying at the forefront of technology and expanding its suite of services to cater to a diverse range of client needs.

Since its inception, Salesforce has embarked on an acquisition strategy to enhance its capabilities and expand its offerings. To date, Salesforce has made 70 acquisitions, with investments totaling $29.1 billion in 2020. Notable acquisitions in Salesforce’s history include:

- Tableau: Acquired for $15.7 billion, Tableau is a renowned data analytics and visualization company, bolstering Salesforce’s data analytics capabilities.

- MuleSoft: Acquired for $6.5 billion, MuleSoft provides integration solutions, facilitating the seamless connection of disparate systems and data sources.

- Demandware: This acquisition strengthened Salesforce’s presence in the e-commerce sector.

- ExactTarget: Known as Salesforce Marketing Cloud, this acquisition enhanced Salesforce’s marketing automation and email marketing capabilities.

- Vlocity: A leader in industry-specific cloud and mobile software, Vlocity expanded Salesforce’s industry solutions.

- Slack: Perhaps one of the most significant acquisitions, Slack was acquired for a whopping $27.7 billion, positioning Salesforce as a comprehensive digital workplace platform.

2016 saw the highest number of acquisitions by Salesforce when it acquired 12 companies in a single year. Collectively, Salesforce has invested over $70 billion in these acquisitions, underscoring its commitment to growth and diversification.

Subsidiaries: Identifying Salesforce subsidiaries can be challenging, as they are often closely integrated into Salesforce’s suite of services. However, some entities are commonly considered Salesforce subsidiaries, including:

- Quip: A collaborative productivity platform, Quip offers tools for document creation and team collaboration.

- Heroku: Heroku is a cloud platform that simplifies the deployment and management of applications.

- MuleSoft: While initially an independent company, MuleSoft is now considered a subsidiary of Salesforce, providing integration solutions.

- Tableau: As a leader in data analytics and visualization, Tableau operates as a subsidiary of Salesforce.

- SoftwareAcumen Solutions: This subsidiary enhances Salesforce’s consulting and implementation services.

- Slack Technologies: Following its acquisition, Slack is now integrated into Salesforce’s ecosystem.

Additional companies are sometimes listed as Salesforce subsidiaries, including Datorama, Inc., ClickSoftware Technologies, Demandware, Inc., BeyondCore, and Clipboard. However, the precise delineation of subsidiaries within the Salesforce ecosystem may vary, reflecting the complex interplay of Salesforce’s services and acquisitions.

Salesforce as an AI Pioneer:

Salesforce, a dominant force in the CRM market, has established itself as a trailblazer in the realm of digital transformation. By enabling both established corporations and startups to harness their data, boost productivity, enhance customer satisfaction, and subsequently increase annual revenues, Salesforce has cemented its position as an industry leader. Amidst the AI and GPT (Generative Pre-trained Transformer) fervor, Salesforce was the first company to boldly venture into AI development, specifically in the field of real estate with a focus on generative AI.

Generative AI and Salesforce’s Passion: Generative AI is a cutting-edge technology that opens up new avenues for Salesforce users by synthesizing various forms of media, including images, text, videos, and sounds, to construct simulated environments or content. This technology continuously evolves and improves itself based on the data it is fed.

In March 2023, Salesforce unveiled Einstein GPT, a generative AI model meticulously designed for CRM purposes. Einstein GPT seamlessly integrates with various Salesforce services, such as OpenAI, ChatGPT technology, the Customer 360 platform, Tableau, Slack, and MuleSoft. As an AI-powered tool, Einstein GPT generates content like personalized emails, invaluable for marketing and sales teams, and provides automated responses to clients, a boon for customer care teams. Additionally, it assists developers by automating code generation.

Taking its AI development to new heights, Salesforce introduced an AI Cloud in June 2023, fundamentally rooted in Einstein GPT. This AI Cloud is engineered to deliver AI capabilities across all of Salesforce’s offerings. It facilitates AI-powered task management, customer behavior analysis, sales and marketing management, and various other processes that empower Salesforce clients to augment their revenue and foothold in the real estate market.

Salesforce is acutely aware of the security and data-related concerns associated with AI. To safeguard customer data, the AI Cloud is constructed on the Einstein GPT Trust Layer. This added layer of security assures users that they can train AI models using their data without the fear of potential data breaches.

Salesforce’s venture into AI, particularly generative AI, represents a pivotal step in enhancing CRM capabilities, revolutionizing customer interactions, and catalyzing growth in the real estate sector while prioritizing data security.

Components of AI Cloud:

- Sales GPT: This component handles tasks such as email auto-generation and automatic meeting scheduling. Sales AI, an extension of Sales Cloud, helps automate and personalize sales-related tasks using Einstein GPT.

- Service GPT: Integrated into the Service Cloud, Service GPT generates personalized replies for customer service chats.

- Marketing GPT: This part of AI Cloud focuses on generating personalized web and advertising content.

- Slack GPT: Enhancing collaboration tools, Slack GPT summarizes conversations, offers AI-driven research, and auto-generates message drafts.

- Einstein GPT for Developers: Development teams can use this AI chat assistant for smart code generation and seek assistance related to Salesforce’s large language models.

Salesforce AI has already gained recognition from industry leaders like Gucci, Inspirato, and RBC US Wealth Management. As more companies realize the potential of Salesforce AI, it is expected that more clients will adopt AI solutions.

Support for AI Start-Ups: Salesforce Ventures is actively supporting AI start-ups with its Generative AI Fund. The fund is expanding from $250 million to $500 million, aimed at assisting high-potential AI start-ups dedicated to generative AI development. Salesforce has already invested in companies like Anthropic, Cohere, You.com, and Hearth. These investments contribute to the growth and innovation in the AI field, further solidifying Salesforce’s position as an AI pioneer.